All Categories

Featured

Table of Contents

Nelson Nash. This publication lays out the Infinite Financial Idea (Self-financing with life insurance). To be honest, I would certainly have instead gotten on the beach than rested in the apartment listening to Father reviewed a financial book to us, however at the exact same time, I was excited because I saw that Dad was excited. My Papa is a Chiropractor.

He remained in method long prior to I was born. It was on that trip, and specifically the message in that publication, Becoming Your Own Lender, that changed the program of our family's life for life. Here's an intro to the Infinite Financial Idea and how McFie Insurance (formerly Life Conveniences) got started.

Nelson Nash, served in the USA Air Pressure, worked as a forestry specialist and later on ended up being a life insurance policy agent and an investor. To obtain cash for his property investments prior to the 1980s, Mr. Nash was accustomed to paying 9.5% accurate he borrowed.

Quickly, Dad was on the phone informing household and buddies about the Infinite Financial Principle. A few months later on, he made a decision to obtain his life insurance policy producer's certificate, so he can create, sell, and service Whole Life insurance policy plans.

What are the tax advantages of Infinite Banking For Financial Freedom?

It had not been simply Papa's company. Mom was working alongside him, and even as young adults, we began assisting nonetheless we could. Prescription For Riches is readily available as a totally free electronic book or audiobook download. If you've researched significantly regarding the Infinite Banking Principle, there's a good opportunity you understand my Daddy as Dr.

You might have even check out one of his books or seen among his video clip presentations on YouTube. Actually, if you don't already have it, you can get his most preferred book, Prescription for Riches, as a complimentary electronic download. The forward to Prescription for Wealth was written by Mr.

As the Infinite Financial Principle caught on, increasingly more people started to desire dividend-paying Whole Life insurance policy policies. Life insurance coverage representatives around the country began to take note. Some agents loved the concept, some agents enjoyed the thought of using the concept as a sales system to market more life insurance policy.

To develop a great plan that works well for the Infinite Financial Idea, you need to reduce the base insurance coverage in the plan and boost the paid-up insurance coverage rider. It's not hard to do, however compensations are paid directly in regard to just how much base insurance coverage is in the policy.

What type of insurance policies work best with Cash Flow Banking?

Some representatives are eager to reduce their commission to develop a good policy for the client, yet lots of representatives are not. However, many life insurance policy representatives told their customers that they were writing an "Infinite Banking Policy" yet wound up creating them a poor Whole Life insurance policy plan, or perhaps worse, some sort of Universal Life insurance policy policy, whether it was a Variable Universal Life insurance plan or an Indexed Universal Life insurance policy plan.

An additional danger to the concept came since some life insurance policy agents started calling life insurance plans "banks". This language caught the interest of some state regulatory authorities and limitations taken place. Things have altered over the last numerous years. The IBC is still around, and it still functions. Mr. Nash's son-in-law, David Stearns, still runs the company Infinite Banking Concepts, which among other things, markets the publication Becoming Your Own Banker.

You can check out my Papa's thoughts on that right here. IBC is typically called "unlimited" due to its flexible and complex approach to individual financing management, specifically via the usage of whole life insurance policy policies. This concept leverages the cash money worth component of whole life insurance policy plans as a personal banking system.

What happens if I stop using Self-banking System?

This access to funds, for any type of reason, without needing to get approved for a car loan in the typical sense, is what makes the principle seem "unlimited" in its utility.: Making use of policy finances to fund business obligations, insurance policy, staff member advantages, or even to infuse capital into partnerships, joint ventures, or as an employer, showcases the versatility and boundless capacity of the IBC.

As always, make use of discernment and note this advice from Abraham Lincoln. If you are interested in infinite financial life insurance policy and are in the market to obtain a good plan, I'm biased, yet I advise our household's business, McFie Insurance policy. Not just have we focused on establishing up excellent policies for usage with the Infinite Banking Idea for over 16 years, however we likewise possess and use the same sort of plans personally.

Either method getting a 2nd opinion can be important. Whole Life insurance policy is still the premier financial asset.

What is the best way to integrate Infinite Banking into my retirement strategy?

I do not see that altering anytime quickly. Whether you have an interest in discovering more about infinite banking life insurance policy or seeking to begin making use of the idea with your very own policy, contact us to arrange a complimentary approach session. There's a great deal of confusion around financing; there's a lot to understand and it's irritating when you do not recognize sufficient to make the most effective monetary choices.

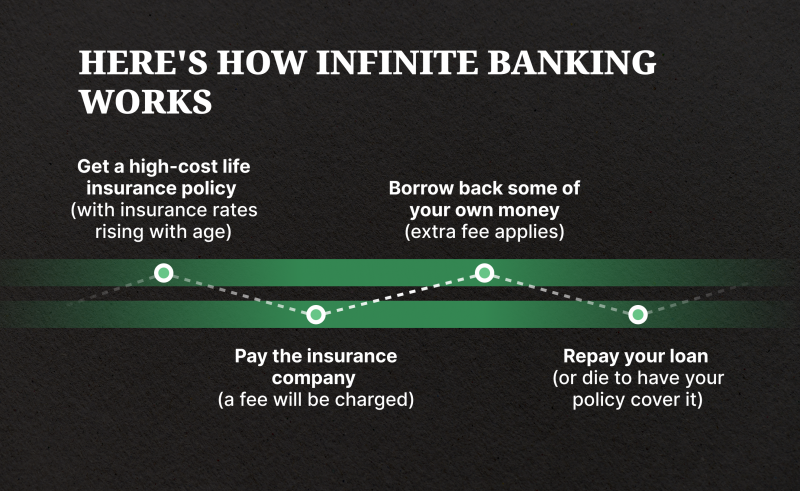

As the principle of Infinite Financial gains appeal in the monetary globe it is essential to recognize the essentials. What is Infinite Banking and exactly how does it function? That is Infinite Financial for? For many newbies, it can be tough to conceptualize. If you're attempting to recognize if Infinite Financial is appropriate for you, this is what you need to understand.

Also numerous individuals, himself included, got right into economic problem due to reliance on banking establishments. In order for Infinite Financial to function, you require your very own financial institution.

What are the risks of using Self-banking System?

The main difference between the 2 is that participating whole life insurance policy plans enable you to participate or receive rewards based on profits of the insurance policy company. With non-participating plans you do not participate or get dividends from the insurance coverage firm.

Additionally, policy loans are tax-free. You can make use of the interest and returns you've gained without paying tax obligations on that particular money. Comparatively, if you withdraw your money value, any type of amount over your basisthe amount you've contributed in insurance premiumswill be tired. In terms of repaying your policy fundings, you work as your own banker and get to determine the repayment routine.

Dividend-paying entire life insurance policy is really low threat and uses you, the policyholder, a large amount of control. The control that Infinite Financial provides can best be grouped into two classifications: tax benefits and asset defenses. Among the factors whole life insurance coverage is excellent for Infinite Financial is exactly how it's tired.

Latest Posts

The First Step To Becoming Your Own Banker

How To Start A Bank

Creating Your Own Bank