All Categories

Featured

Table of Contents

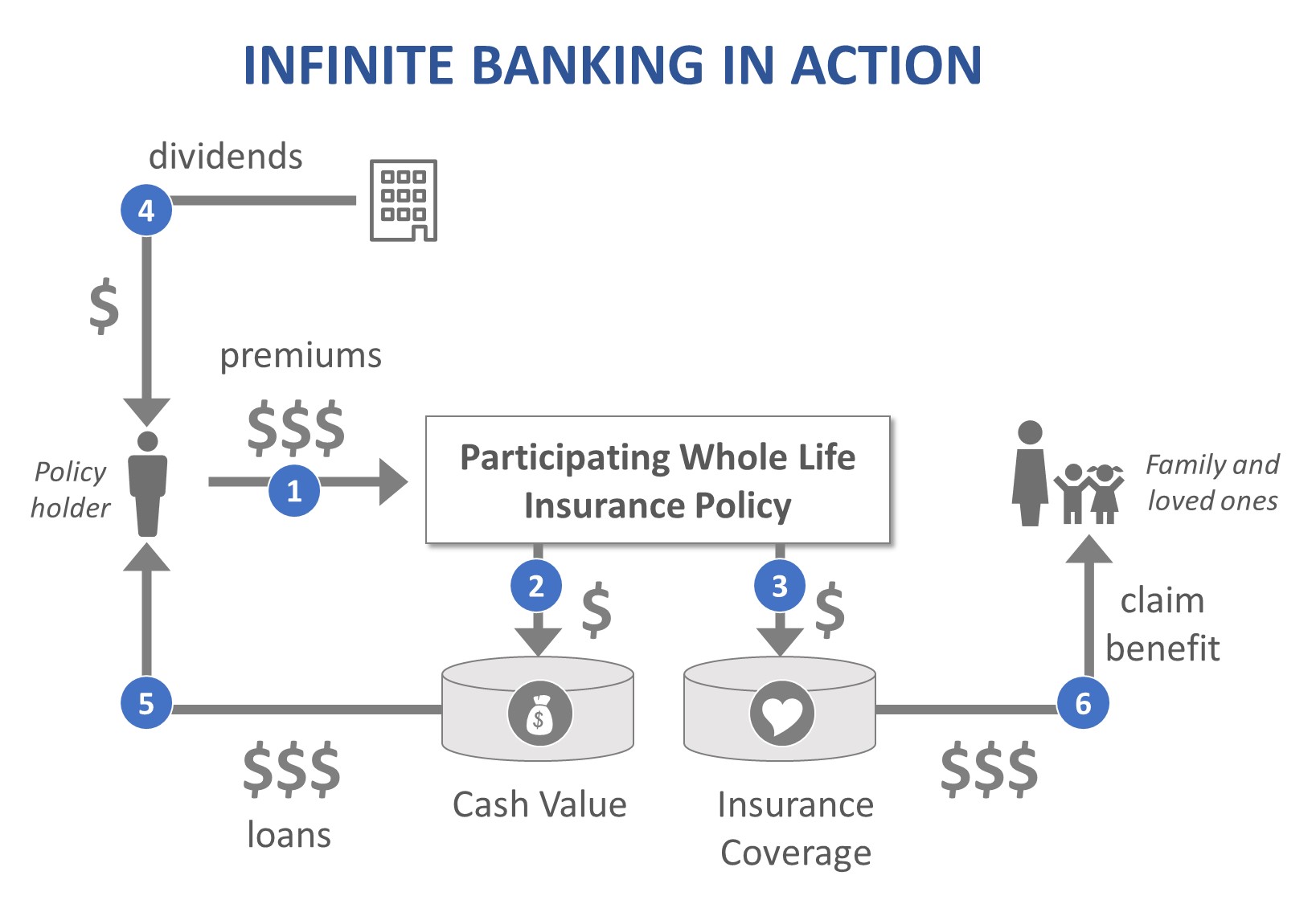

The approach has its very own benefits, but it additionally has problems with high fees, complexity, and a lot more, resulting in it being considered as a fraud by some. Boundless banking is not the best plan if you need only the investment component. The infinite banking concept revolves around the usage of entire life insurance policy plans as a financial device.

A PUAR allows you to "overfund" your insurance coverage right approximately line of it ending up being a Modified Endowment Agreement (MEC). When you use a PUAR, you rapidly boost your cash money value (and your death benefit), therefore increasing the power of your "financial institution". Additionally, the more cash worth you have, the higher your rate of interest and returns settlements from your insurance provider will be.

With the increase of TikTok as an information-sharing system, economic suggestions and techniques have actually located a novel method of dispersing. One such strategy that has been making the rounds is the boundless banking concept, or IBC for short, amassing recommendations from celebs like rap artist Waka Flocka Flame - Infinite Banking concept. Nonetheless, while the technique is currently popular, its roots trace back to the 1980s when economic expert Nelson Nash presented it to the globe.

How do interest rates affect Financial Independence Through Infinite Banking?

Within these plans, the cash money worth grows based on a price set by the insurance provider. Once a significant cash money worth accumulates, insurance policy holders can obtain a money value financing. These loans vary from traditional ones, with life insurance policy working as security, indicating one could shed their insurance coverage if borrowing excessively without appropriate money worth to sustain the insurance policy prices.

And while the allure of these plans is obvious, there are inherent restrictions and dangers, requiring thorough cash money worth surveillance. The technique's authenticity isn't black and white. For high-net-worth people or organization owners, specifically those utilizing techniques like company-owned life insurance policy (COLI), the benefits of tax breaks and substance growth could be appealing.

The attraction of unlimited financial does not negate its obstacles: Cost: The fundamental demand, a permanent life insurance policy plan, is costlier than its term equivalents. Eligibility: Not everyone receives entire life insurance policy as a result of strenuous underwriting procedures that can leave out those with details wellness or way of living problems. Complexity and threat: The elaborate nature of IBC, combined with its dangers, may prevent numerous, specifically when less complex and less high-risk choices are available.

Cash Value Leveraging

Designating around 10% of your regular monthly revenue to the policy is simply not feasible for a lot of people. Part of what you review below is merely a reiteration of what has actually currently been claimed above.

Before you obtain yourself into a circumstance you're not prepared for, know the adhering to first: Although the idea is commonly marketed as such, you're not in fact taking a funding from on your own. If that held true, you wouldn't have to settle it. Rather, you're obtaining from the insurer and have to repay it with rate of interest.

Some social media posts suggest using money worth from entire life insurance to pay down credit card financial obligation. When you pay back the financing, a section of that rate of interest goes to the insurance company.

How does Cash Flow Banking create financial independence?

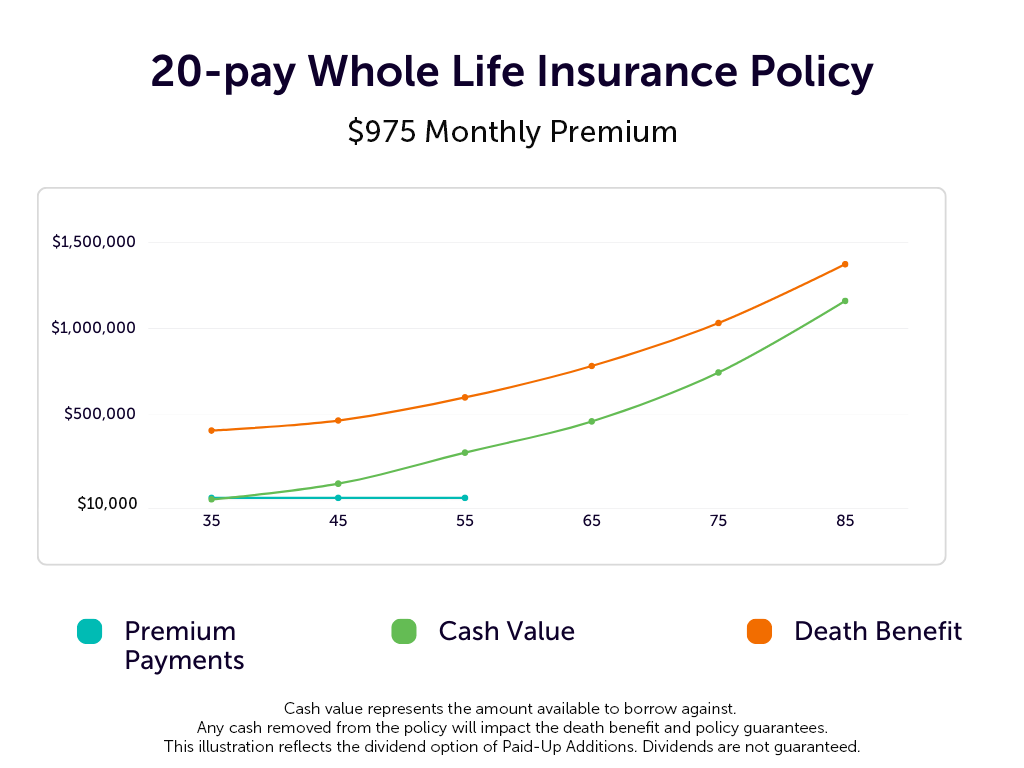

For the very first several years, you'll be repaying the payment. This makes it extremely hard for your plan to collect worth throughout this time. Whole life insurance policy prices 5 to 15 times much more than term insurance coverage. The majority of people merely can't afford it. So, unless you can pay for to pay a couple of to numerous hundred bucks for the following decade or even more, IBC will not benefit you.

If you require life insurance coverage, right here are some beneficial pointers to take into consideration: Take into consideration term life insurance. Make sure to go shopping around for the ideal rate.

How long does it take to see returns from Infinite Banking Account Setup?

Visualize never having to stress about financial institution lendings or high passion prices again. Suppose you could borrow money on your terms and develop wide range simultaneously? That's the power of boundless banking life insurance coverage. By leveraging the cash value of whole life insurance policy IUL plans, you can expand your wealth and obtain money without counting on typical financial institutions.

There's no collection financing term, and you have the freedom to choose the settlement schedule, which can be as leisurely as settling the funding at the time of death. This adaptability reaches the maintenance of the finances, where you can choose interest-only repayments, maintaining the lending equilibrium level and workable.

What makes Infinite Banking Benefits different from other wealth strategies?

Holding money in an IUL dealt with account being attributed interest can usually be better than holding the money on deposit at a bank.: You've constantly imagined opening your very own pastry shop. You can borrow from your IUL plan to cover the preliminary costs of leasing a space, purchasing tools, and employing staff.

Personal lendings can be acquired from standard banks and credit rating unions. Borrowing cash on a credit card is usually really pricey with yearly percentage prices of passion (APR) typically getting to 20% to 30% or even more a year.

Latest Posts

How do I qualify for Generational Wealth With Infinite Banking?

What are the common mistakes people make with Infinite Banking?

Leverage Life Insurance